India Form 28a free printable template

Show details

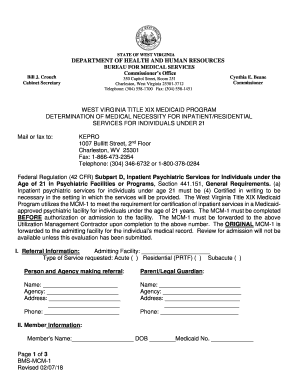

FORM NO. 28A See rule 39 Intimation to the Assessing Officer under section 210 5 regarding the notice of demand under section 156 of the Income-tax Act 1961 for payment of advance tax Dated To The Assessing Officer Sir Re. Notice of demand under section 156 of the I. T. Act 1961 for payment of income-tax under section 210 3 /210 4 of the Act in the case of For assessment year. The notice of demand under section 156 of the Income-tax Act for payment of advance tax and the order on date of...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign form 28 a

Edit your 28a form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 28a form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing form 28 online

To use our professional PDF editor, follow these steps:

1

Log in to your account. Start Free Trial and register a profile if you don't have one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit 28 a form. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

Dealing with documents is simple using pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out section 28 form

How to fill out India Form 28a

01

Begin by downloading the India Form 28A from the official website or obtain a physical copy from the designated office.

02

Fill in your personal details accurately, including name, address, and contact information.

03

Provide the details of the property or assets involved in the transaction.

04

Specify the reasons for the application, clearly stating your intentions.

05

Attach any required documents, such as proof of identity, address proof, and supporting documents related to the property.

06

Review the form for any errors or omissions to ensure all information is complete.

07

Sign the form at the designated section.

08

Submit the completed form to the relevant authority, either online or via postal service, as per the instructions.

Who needs India Form 28a?

01

Individuals or entities seeking to obtain permission for certain property transactions.

02

Foreign citizens or NRIs looking to buy property in India.

03

Individuals applying for certain approvals or registrations related to property ownership.

Fill

form 28 pdf download

: Try Risk Free

People Also Ask about form 28 sample filled pdf

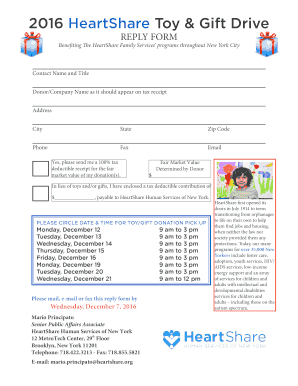

Who is eligible for NYC-210?

Who can file NYC-210? If you qualify for the NYC school tax credit and are not filing a tax return on Form IT-201 or IT-203 for 2022, use Form NYC-210 to claim your NYC school tax credit. File your Form NYC-210 as soon as you can after January 1, 2023. You must file your 2022 claim no later than April 15, 2026.

What is the NYC nonresident income tax return?

Any New York City employee who was a nonresident of the City (the five NYC boroughs) during any part of a particular tax year must file an 1127 return. In most cases, if you received an 1127.2 statement from your employer, you must file an 1127 return.

What is a NYC-210 tax form?

Form NYC-210, Claim for New York City School Tax Credit.

What is a IT-201 form?

Form IT-201-V, Payment Voucher for Income Tax Returns, to make a payment by check or money order. Form IT-225, New York State Modifications, to report New York State addition or subtraction modifications to federal AGI other than those specifically listed on Form IT-201.

Who qualifies for New York City School tax credit?

New York City school tax credit (fixed amount) You are entitled to this refundable credit if you: were a full-year or part-year New York City resident, cannot be claimed as a dependent on another taxpayer's federal income tax return, and. had income of $250,000 or less.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit income tax act section 28 online?

pdfFiller allows you to edit not only the content of your files, but also the quantity and sequence of the pages. Upload your form 28 download to the editor and make adjustments in a matter of seconds. Text in PDFs may be blacked out, typed in, and erased using the editor. You may also include photos, sticky notes, and text boxes, among other things.

How do I make edits in 28 number form without leaving Chrome?

form 28 pdf can be edited, filled out, and signed with the pdfFiller Google Chrome Extension. You can open the editor right from a Google search page with just one click. Fillable documents can be done on any web-connected device without leaving Chrome.

How do I complete form 28 29 30 on an iOS device?

Make sure you get and install the pdfFiller iOS app. Next, open the app and log in or set up an account to use all of the solution's editing tools. If you want to open your form no 28, you can upload it from your device or cloud storage, or you can type the document's URL into the box on the right. After you fill in all of the required fields in the document and eSign it, if that is required, you can save or share it with other people.

What is India Form 28a?

India Form 28a is a form used for the submission of a request for obtaining a Tax Deduction Account Number (TAN) for a business or organization in India.

Who is required to file India Form 28a?

Any individual or entity that is liable to deduct tax at source in India is required to file India Form 28a.

How to fill out India Form 28a?

To fill out India Form 28a, you need to provide details such as the applicant's name, type of deductor, address, and other relevant information as instructed in the form.

What is the purpose of India Form 28a?

The purpose of India Form 28a is to facilitate the process of obtaining a TAN, which is necessary for the deduction and payment of tax on behalf of the Government of India.

What information must be reported on India Form 28a?

India Form 28a requires reporting information such as the name of the deductor, address, type of deductor, and any other information specified in the form's guidelines.

Fill out your India Form 28a online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form 28 Filled Sample is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.